Montessori for the price of Childcare

The Child Care Subsidy (CCS)

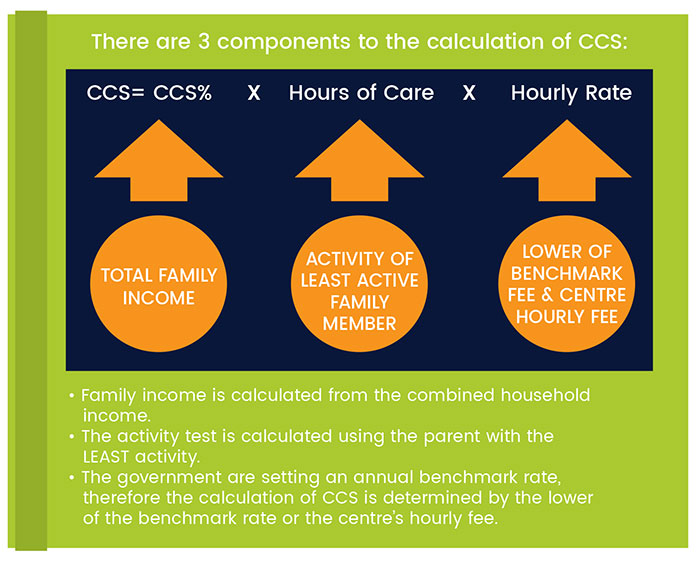

The Child Care Subsidy provides eligible families a rebate of up to 85% of their fees. It is means tested based on the combined family income, the fortnightly activity of families – such as work, study or volunteering – and the type of service a child attends.*

We encourage all families to perform the assessment online to confirm their eligibility.

>Our service details

>Learn about how CCS is calculated

>How do I complete my CCS assessment online

>How do I complete my CCS if I've previously claimed CCB/CCR

>How do I confirm my enrollment in myGov

>How do I check my subsidy level in myGov

>Steps to apply for Additional Child Care Subsidy Temporary Financial Hardship

>What is the balancing process?

How is CCS Calculated

These tax brackets will be adjusted as per CPI every financial year.

| Hours of activity (per fortnight) | Maximum number of hours of subsidy (per fortnight) |

|---|---|

| 8 hours to 16 hours | 36 hours |

| 16 hours to 48 hours | 72 hours |

| More than 48 hours | 100 hours |

What counts as activity?

Under the new system, you will only be able to access the Child Care Subsidy if you are doing suitable activity and the amount of activity will then determine how many hours of Childcare Subsidy you are eligible for.

Activity counts as:

- Paid work (including unpaid lunch breaks)

- Commute time from childcare centre to work (excludes time travelling from home to childcare centre and vice versa)

- Authorised leave (eg maternity leave, long service leave, annual leave etc)

- Unpaid leave of up to 6 months

- Unpaid work in a family business

- Setting up a new business

- Study

- Training and study (includes semester breaks)

- Work experience/internships (whether paid or not)

- Volunteering

- Looking for work (eg internet research, contacting employers, preparing resumes/letters of application, preparing for and attending job interviews, travel time for interviews)

Concerned you won’t have enough activity?

- Activity is based on the family’s estimate over a thirteen week period

- For casual/contract/itinerant workers whose hours may vary from week to week, you should pick the week with the highest level of activity in the thirteen week period and use that as your level of activity

- You can go onto myGov and change your activity level at any time

- While you do not have to verify your activity, the Government has said that it will look to audit about 10% of families each year to seek some form of verification that the activity is valid

- Families earning less than $64,710 are exempt from activity tests for up to 24 hours care per fortnight

Hours spent engaging in different recognised activities can be combined together to determine your

entitlement of subsidised hours.

Examples

Example – participating in an approved course of education or study

Emma and Rowan live in Wangaratta, Victoria.

- Emma works full time as the manager of a supermarket.

- Rowan has decided to attend university to study graphic design. He spends three days a week on

campus and attends 15 hours of classes and tutorials. - Rowan also spends 10 hours per week at home completing assignments and listening to lectures online.

- They have a three-year old son named Kieran who attends a centre based day care service.

- Whenever Rowan goes to university he drops Kieran at the service, and later in the day, he picks him up.

- Rowan’s university is a one-hour drive from the service.

- When Rowan is calculating his activity level, he is allowed to include a reasonable amount of the time he spends travelling between the service and where he is studying.

- Rowan’s activity level totals 62 hours per fortnight (30 hours of contact hours (attending class) + 20 hours of self-directed study + 12 hours of travel).

Both Emma’s work and Rowan’s studies are for more than 48 hours per fortnight, so they will be entitled

to 100 hours of subsidised care per fortnight.

Example – a family is setting up a business

George and Maria live in Wandi, Western Australia.

- George is setting up a new family farm business selling organic eggs.

- He spends 45 hours per fortnight doing this.

- Maria is a rural nurse and works 50 hours per fortnight.

- They have a young daughter who attends a centre based day care service.

- Because George is actively setting up a business, his time is spent:

• attending conventions

• pitching his idea to investors

• organising his online store, and

• other related tasks, which all count towards his activity level for six months (i.e. for this activity, up to 13 fortnights will be recognised out of every 12 months, and do not have to occur consecutively).

George and Maria will be entitled to 72 hours of subsidised care for their child each fortnight. This is based on George’s activity level as his is the lowest.

Later, when George begins to operate his business, he can update his circumstances with Centrelink and

report his hours of business activity as paid work (self-employed).

For more information, see the fact sheet on the Child Care Subsidy activity test.

What is the Pre-School Exemption?

Parents who do not meet and are not otherwise exempt from the Child Care Subsidy activity test will be entitled to 36 hours of subsidised care per fortnight to support their preschool-aged child. This is possible because Northwest Montessori is classified as a Centre Based Care service with an integrated Pre-School program.

Click this link to learn more about the Pre-School Activity Test Exemption.

Visit the Government’s website on the new system here.

How to apply for the CCS if you have never claimed benefits before

Step 1: get started

From your Centrelink homepage, select Make a claim.

On the Make a Claim page, select Get started in the Families category.

Select Apply for Family Assistance (including Paid Parental Leave).

We’ll ask you some questions to check if you’re eligible for the payment you’ve chosen.

This helps you decide if you should claim this type of payment.

Answer all the questions then select Next. You may need to work through more than one page.

If you need help, select the question mark icon.

Step 2: claim for Child Care Subsidy

The next page will show the different types of family assistance you can claim. Select Child Care Subsidy, followed by Claim now.

You can claim this subsidy and other family assistance payments at the same time. To do this, select any additional payments you want to claim before selecting Claim now.

We’ll prompt you to check your details in My Profile to make sure they’re up to date. Select My Profile to check your details.

From the My profile page, you can check and update your details. When you’ve finished, select return to your claim to go back to your claim.

Step 3: tell us about your situation and finances

We’ll give you a claim number which is your claim ID. Use your claim ID if you need to follow up with us about your claim. You can contact us over the phone or in person at a service centre.

To begin your claim, select Get started in Confirm your basic details.

The next page will display tabs you need to work through. Answer all the questions, then select Next.

Once you complete a step, the word Completed will show on that tile.

Select:

- Change, to edit the information you entered

- Save and Exit, to save your claim and finish it later

Work through the remaining steps until they’re all Completed.

Step 4: review claim

To review your claim, select Continue in Review your claim and submit.

On the Review your claim page, we’ll give you a summary of your claim. If you haven’t completed all required details, an Update required message will appear. You must complete these sections before moving on.

Select:

- Expand section, to see the information you gave us

- Update, to edit the details if they’re incorrect

- Print, to print your claim summary

If all the details are correct, select and read my obligations. If you understand and agree with your obligations, select I have read, understood and accept my obligations. Then select Next.

Step 5: submit supporting documents

Before you can submit your claim, there are tasks you must complete.

Tasks may include giving us documents to support your claim. These tasks will appear as Required in the Status column.

To upload and submit a document, select Upload.

If you don’t have your documents ready, you can submit them later. To do this, use the Upload documents link on your online account homepage. You can also upload documents through the Express Plus Centrelink mobile app. You can do this by taking photos of your documents and uploading them to the app. You have 14 days to submit your documents to support your claim.

For help submitting your documents, follow our Submit documents with your Centrelink online account guide.

Select a document type from the drop down menu.

Select Choose files to select the document you want to upload.

Once you upload your documents, read the declaration. If you understand and agree with the declaration, select I have read, understand and accept the declaration. Then select Submit documents.

We’ll give you a receipt when you submit your supporting documents. Please make a note of the Receipt Number for your records.

Select Return to Child Care Subsidy Claim so you can submit your claim.

Once you’ve submitted your documents, the status of the task will change to Done. Repeat for all tasks.

Once you’ve submitted all documents we ask for, select Submit.

Step 6: submit claim

Once you submit your claim, we’ll confirm that you’ve submitted it. There’s no need to call us.

We’ll notify you once we’ve assessed your claim. Please make a note of the Claim ID for your records. We’ll also give you an Estimated completion date of when we'll process your claim.

Select:

- Withdraw claim, to withdraw your claim if required

- Notifications, to view any messages about your claim

- Tasks, to view a list of your completed tasks and edit them if required

- Review claim details, to view the information you’ve given us

Select home page to return to your online account homepage.

Step 7: sign out

You can track the progress of your claim from your homepage. Select More details at any time to see what stage your claim is at.

From your homepage, you can complete other transactions or select the myGov icon to return to myGov.

Confirming your enrollment in myGov

Step 1: get started

If you're not already in your Centrelink online account, sign into myGov and access your account.

From your homepage, select MENU, followed by Child Care Subsidy then Enrolments.

Step 2: view and confirm your child’s details

On the Child Care Subsidy Enrolments page you can view your child’s enrolment details. Under Enrolment status you can see if you've confirmed the details or not.

For any that say Unconfirmed, you must confirm or dispute the details. Select Review next to the enrolment status to do this.

This will take you to a new page. Check the information on this page carefully. If your child’s enrolment details are correct, select Yes. If they're wrong, select No. Once you’ve done this, select Next.

If you select No you’ll need to speak to your child care service. They'll need to submit the correct details. Once they do this you’ll need to start this process again from Step 1.

If you select Yes, go to Step 3 to review and submit.

Step 3: review and submit

We’ll give you a summary of your details.

Make sure all the information is correct.

If you understand and agree with the declaration, select I accept this declaration, then Submit.

Step 4: receipt

We’ll give you a receipt to let you know we’ve got your update. There’s no need to call us.

We’ll notify you once we’ve assessed your claim.

Please make a note of the Receipt ID for your records, then select Return to Home.

From the homepage you can check if you’ve confirmed your child’s enrolment details.

To do this select MENU, followed by Child Care Subsidy then Enrolments.

This will take you to a page that shows you an enrolment summary. If you’ve confirmed your child’s enrolment details, the enrolment status will show as Confirmed.

Step 5: sign out

From your homepage, you can complete other transactions or select the myGov icon to return to myGov.

For your privacy and security, sign out when you've finished using your myGov account.

Updating your Activity Level

Please see this link for detailed steps:

The Balancing Process

After the end of the financial year the Government compares your income estimate with your actual income. This is to make sure they pay you the correct amount of CCS.

Watch this video to find out more about balancing family assistance payments.

Steps to apply for Additional Child Care Subsidy Temporary Financial Hardship

1. Get ready to apply

1. Get ready to apply

The easiest way to apply is online.

To apply online, you need a myGov account linked to Centrelink. If you don’t have a myGov account or a Centrelink online account you’ll need to set them up.

2. Get your documents ready to apply

2. Get your documents ready to apply

You’ll need to get some supporting documents ready to help answer some of the questions in the application.

3. Make your application

3. Make your application

- Sign in to myGov and go to Centrelink.

- Select My Family from the menu.

- Select Child care then Temporary financial hardship.

- Select Yes to confirm that you have read and understood the criteria you must meet to get Additional Child Care Subsidy.

- Answer all the questions. Each screen has information to help you complete the application. This includes how to submit your supporting documents and any other forms you need to complete.

- Review and submit your application.

When you're ready:

4. After you apply

4. After you apply

After you submit your claim online, you’ll get a receipt telling you the ID number of your application.

This receipt will tell you what other documents you need to provide so we can assess your application.

They will send a letter to either your: